You will need to create an account before you can add in the details of your Council Tax, Housing benefit, Business rates or Landlord services.

We have guides on setting up and account and how to then add in the services you want to manage.

You will need to create an account before you can add in the details of your Council Tax, Housing benefit, Business rates or Landlord services.

We have guides on setting up and account and how to then add in the services you want to manage.

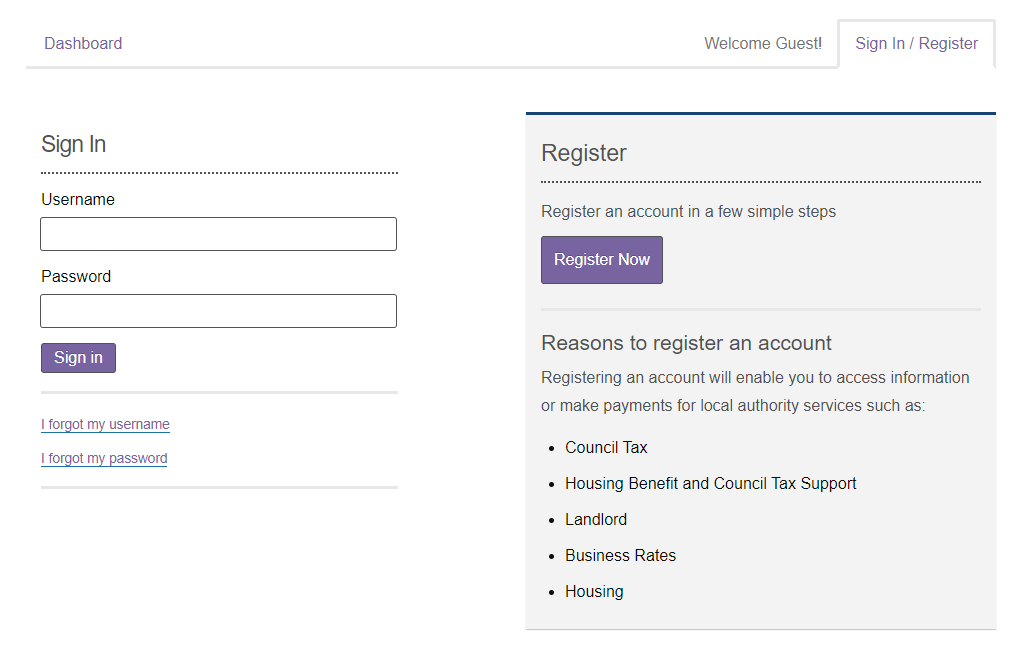

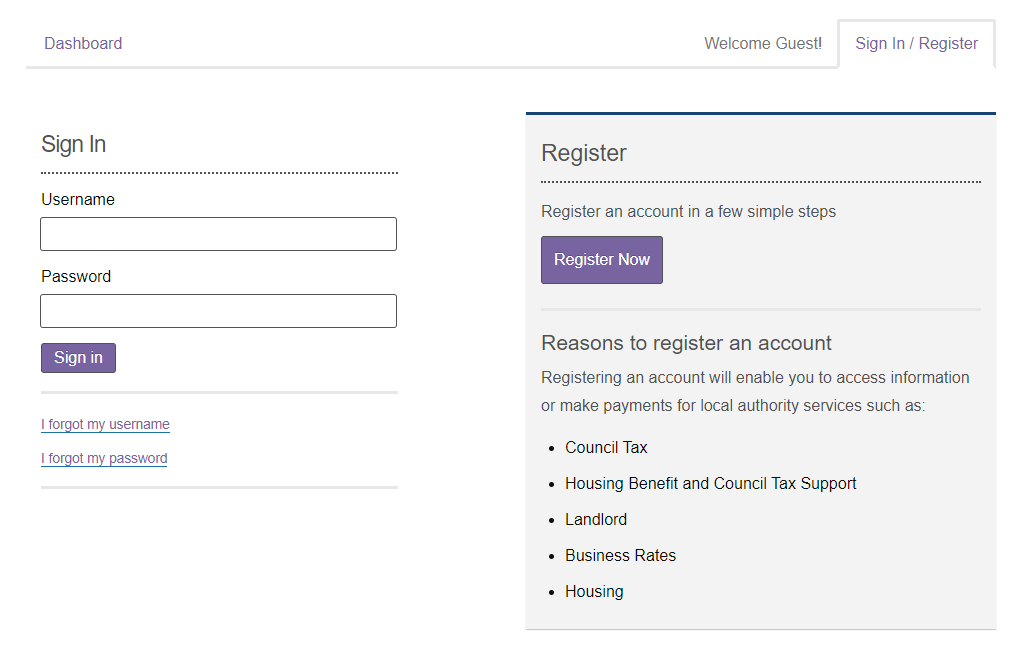

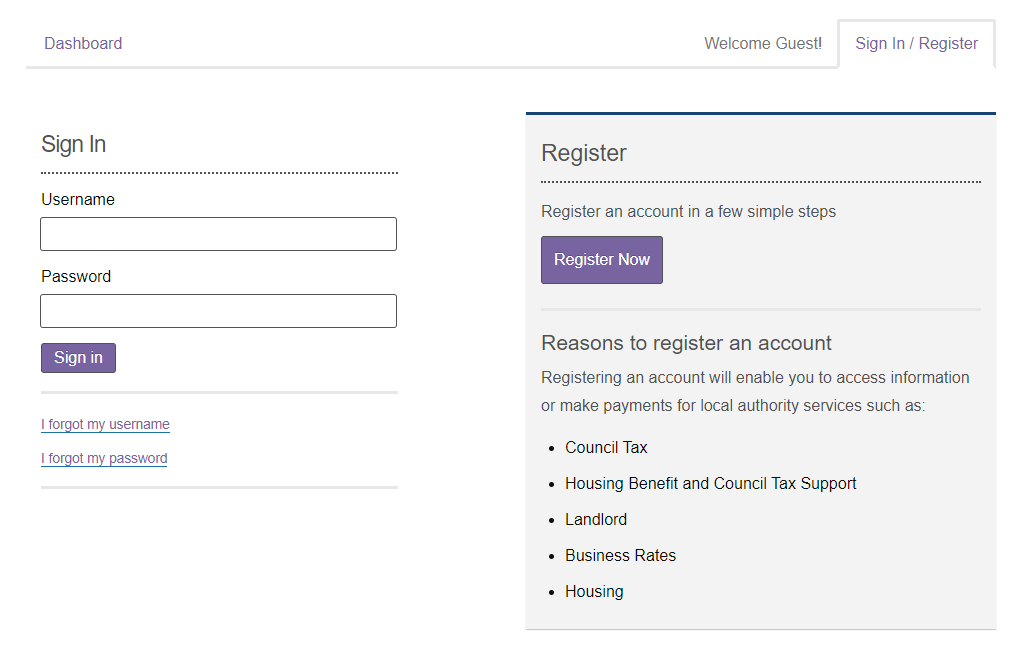

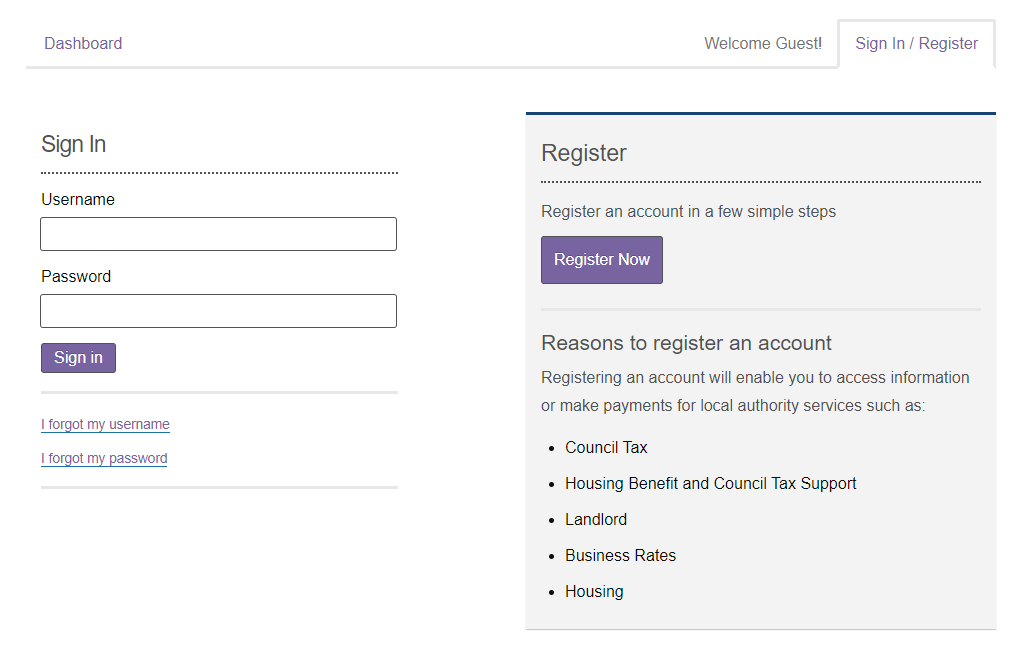

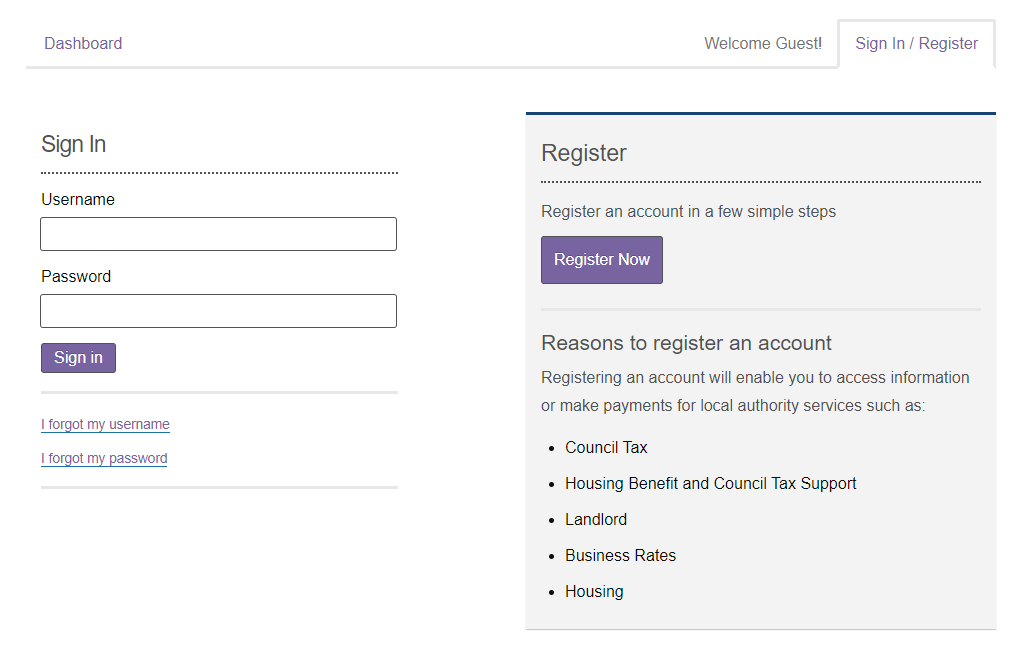

You need to visit our online account website and press the register now button.

Warrington Citizen Portal Sign in or Register

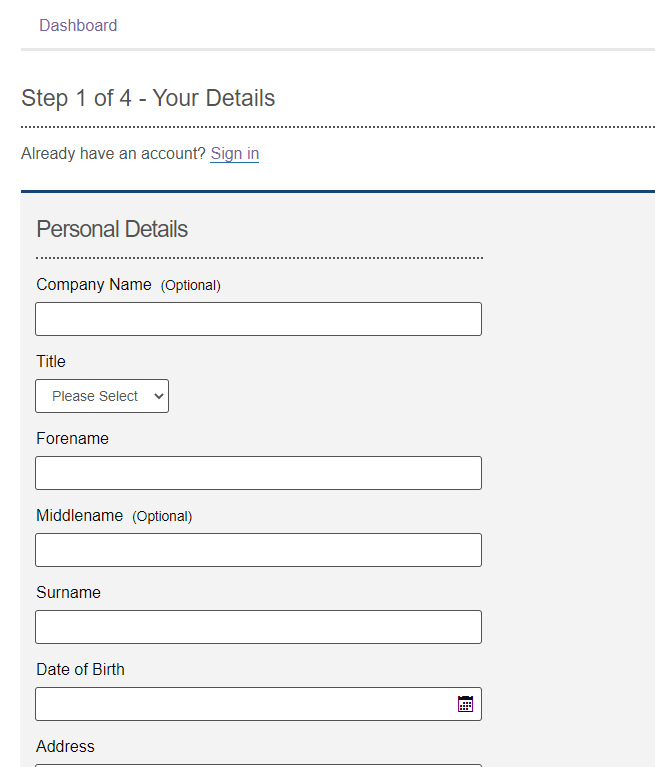

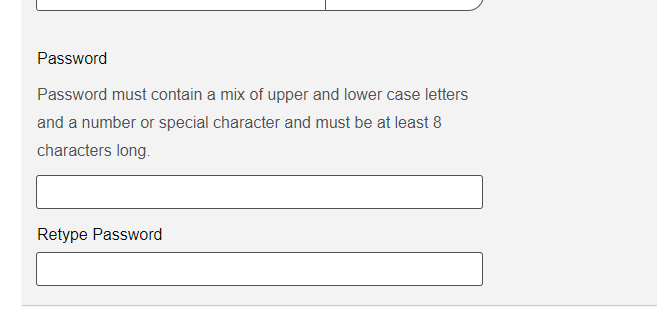

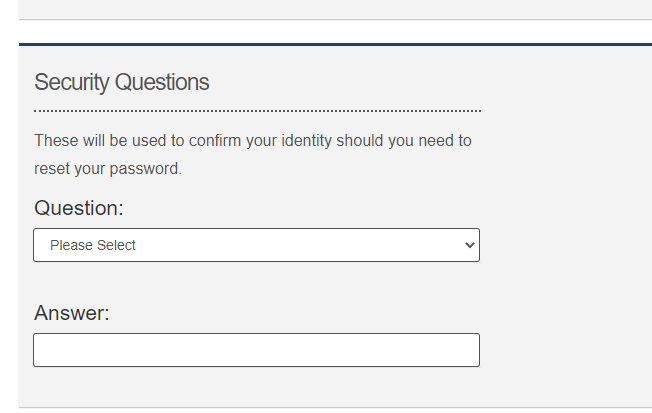

You will need to complete the details of the registration form by giving us your personal contact details, setting a password and a security question.

You will need to create a password to keep your account secure. Your password needs to be at least 8 characters long and have at least one capital letter, one lowercase letter and one number or one special character.

You could use a combination of letters and numbers you can remember - A2bn*tA2

You could use the first letters of a phrase eg. "I'm not very good at remembering passwords for websites" which would be Invgarpfw. You could use a line from a film or a song as long as there is 9 characters or more. We just need to make sure we have a mixture of letters, numbers and special characters so we get the password - Invg@rPfw

You could pick some words you would remember and change some letters to numbers. eg. Daisy Rabbit could make the password D41sy!R4bb1t

Please don't use passwords that would be easy to guess such as family names or dates of birth.

Add your personal details

Add an account password

Choosing a security question from the list

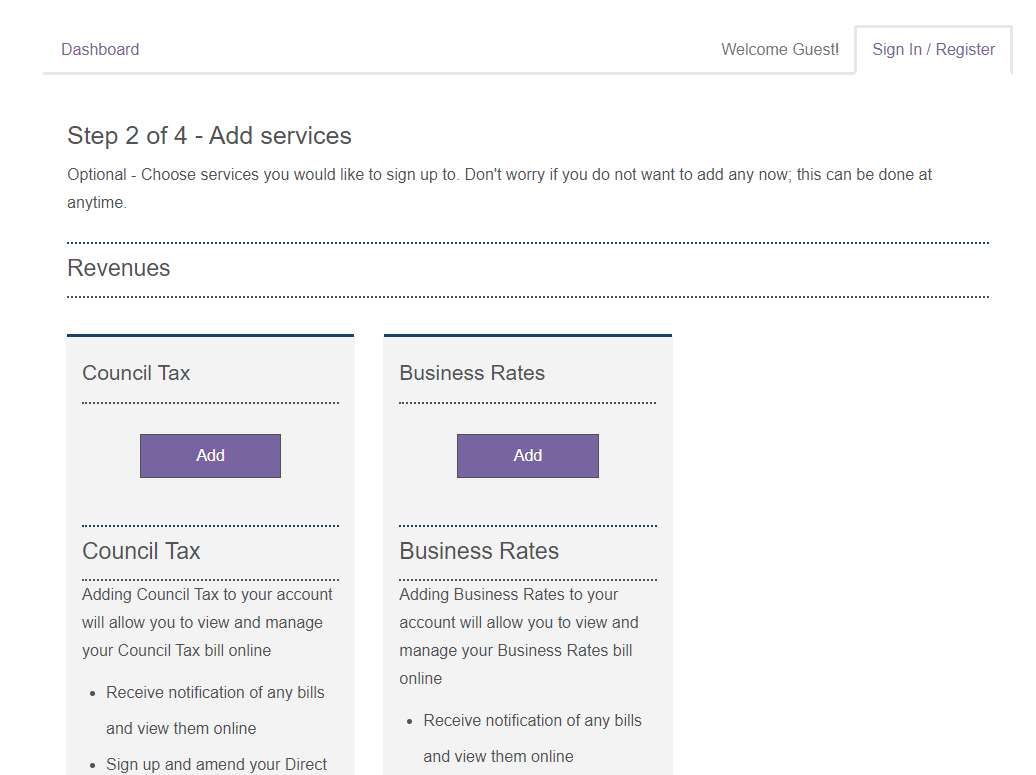

You can add any services you wish in this part of the registration process. You can always skip this step and add them later.

Please read the guides further down this page so you know what information you will need to tell us.

Adding services to your account

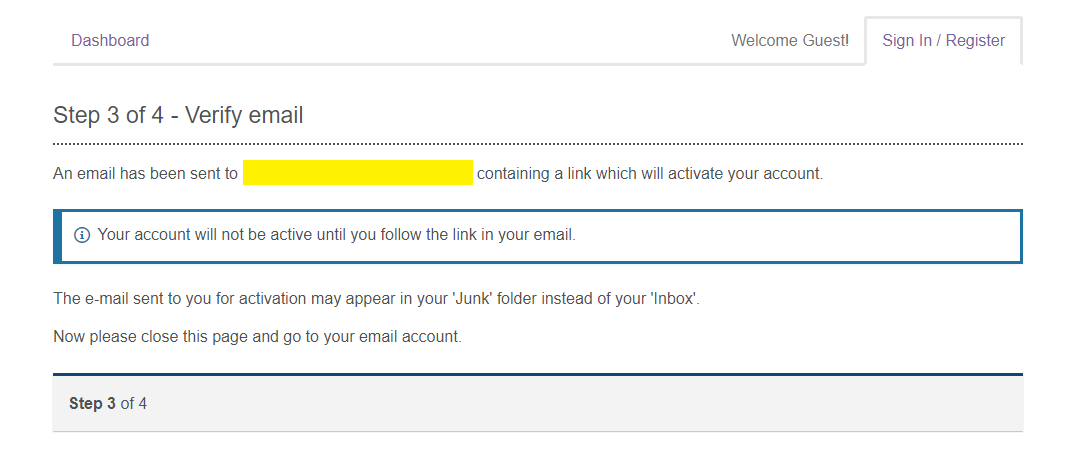

We will send an email to the address you gave us. Please go to your email and look for the message we have just sent you. In it you will need to click the confirmation link to activate your account.

Can't find the email?

Please check your junk or spam folders to see if it is there.

Checking your email address

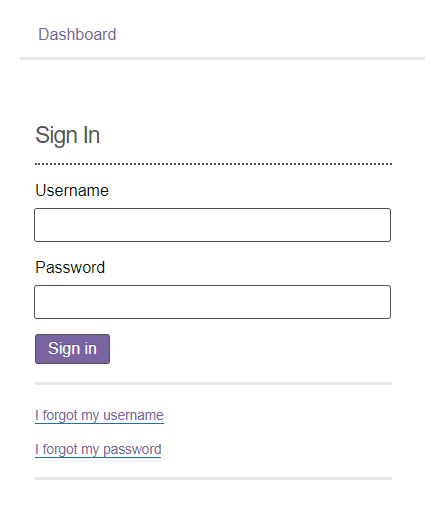

When you click the link on the email, your account will be registered and you can now Sign In with your Username and Password.

Sign in

Please make sure you have set up an account first

Which service would you like to add?

Before you begin

We will ask you for some information from the following list to link your online account and your Council Tax account. You may not have all the details listed, however the more information you have the better.

Follow these simple steps to add the Council Tax service to your account.

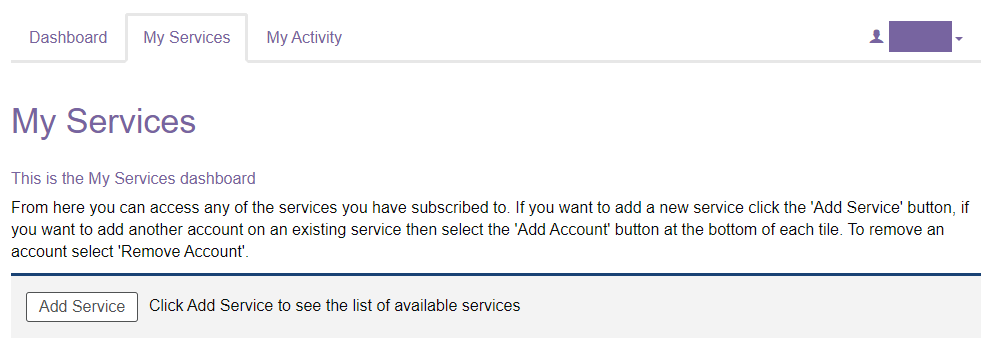

Sign in to the Citizen Portal

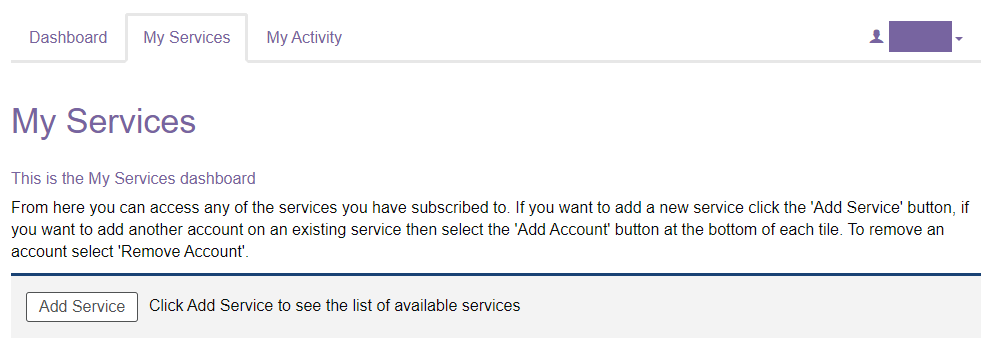

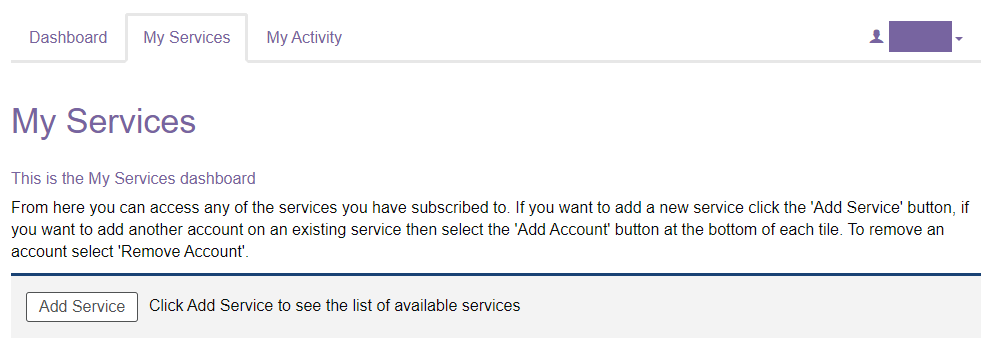

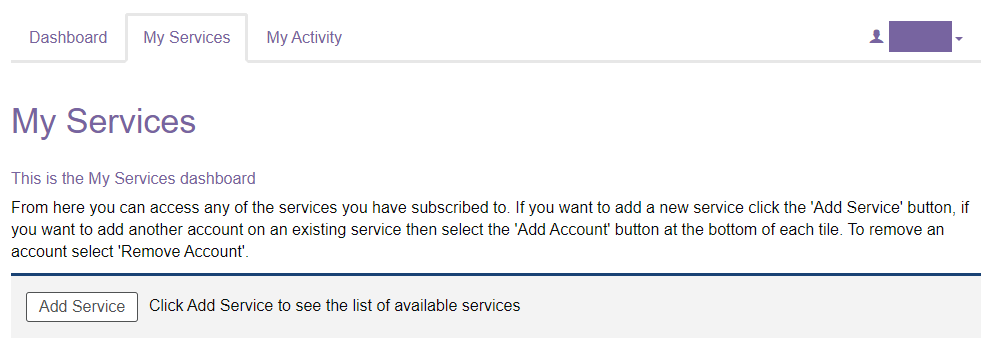

Click on the 'My Services' Tab and Add Service and select Council Tax using the button, or

My services

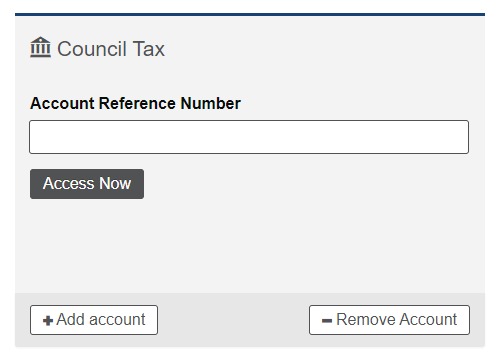

Enter your Council Tax account number into the Council Tax Panel and click the Access Now button

Add Council Tax Panel

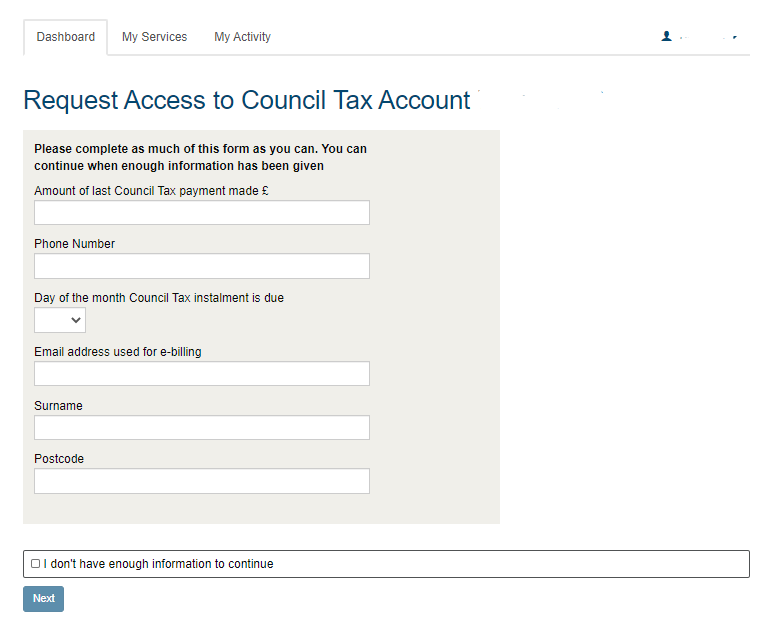

We will ask you for some information related to the Council Tax account so we can then link your online and Council Tax accounts. Please answer the questions and click the Next Button

If we have enough information, we will link your Council Tax to your account and the website will take you back the My Services page.

Request Access Questions

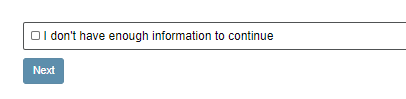

If you don't have the information to continue, tick the don't have enough information box and click the next button.

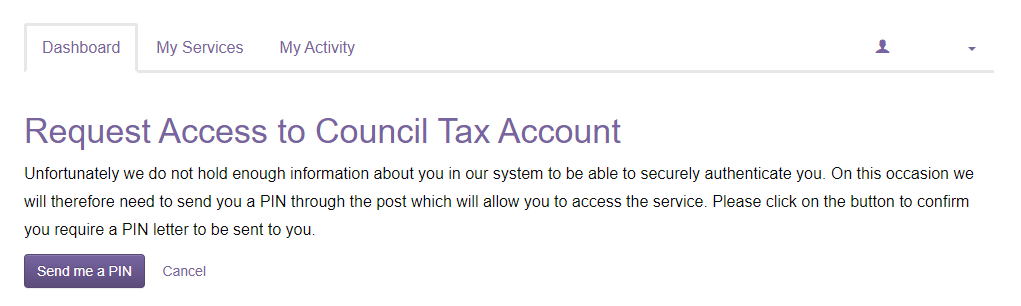

At this point we can't verify the Council Tax account so we will send a letter to your address with a PIN number and instructions of how to use it to link your Council Tax Account.

I don't have enough information tick box

Send me a PIN panel

Before you begin

We will ask you for some information from the following list to link your online account and your Housing Benefit. You may not have all the details listed, however the more information you have the better.

Sign in the Citizen Portal

Click on the 'My Services' Tab and Add Service and select Housing Benefit using the button, or

My services

Enter your Housing Benefit claim reference number into the Housing Benefit Panel and click the Access Now button

Add Housing Benefit Panel

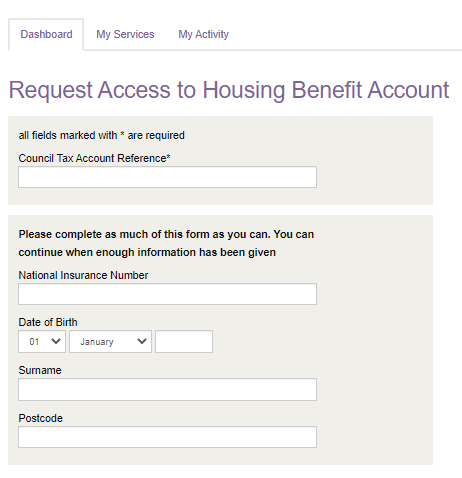

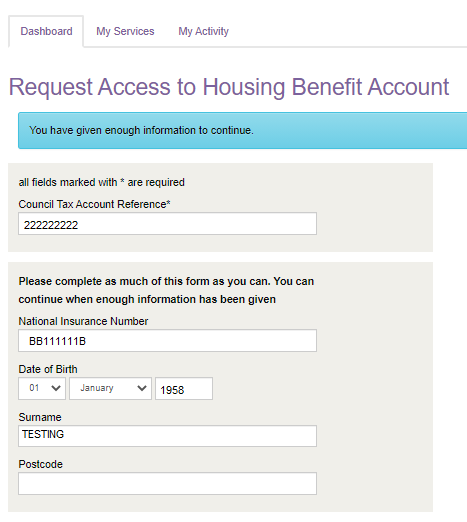

We will ask you for some information related to your Housing Benefit so we can then link your online and Housing Benefit accounts. Please answer the questions and click the Next Button

If we have enough information, we will link your Housing Benefit to your account and the website will take you back the My Services page.

Request Access Questions

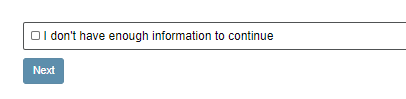

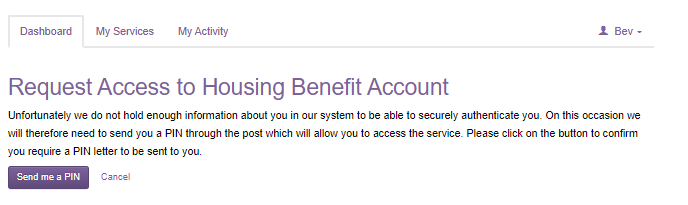

If you don't have the information to continue, tick the don't have enough information box and click the next button.

At this point we can't verify your Housing Benefit account so we will send a letter to your address with a PIN number and instructions of how to use it to link your Housing Benefit.

I don't have enough information tick box

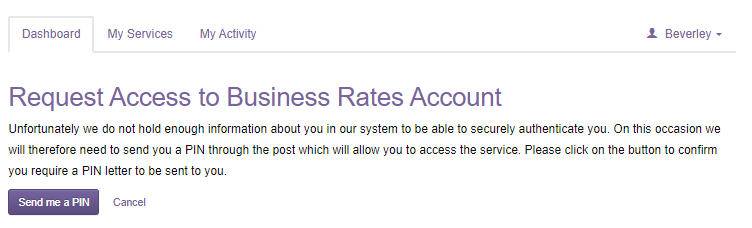

Send me a PIN panel

Before you begin

We will ask you for some information from the following list to link your online account and your Business Rates account. You may not have all the details listed, however the more information you have the better.

Sign in to the Citizen Portal

Click on the 'My Services' Tab and Add Service and select Business Rates using the button, or

My services panel

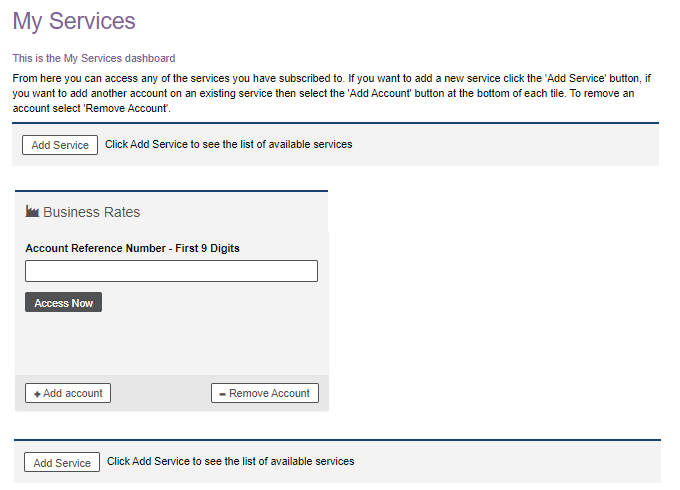

Enter your Business Rates Account Reference number into the Business Rates Panel and click the Access Now button

Add Business Rates Panel

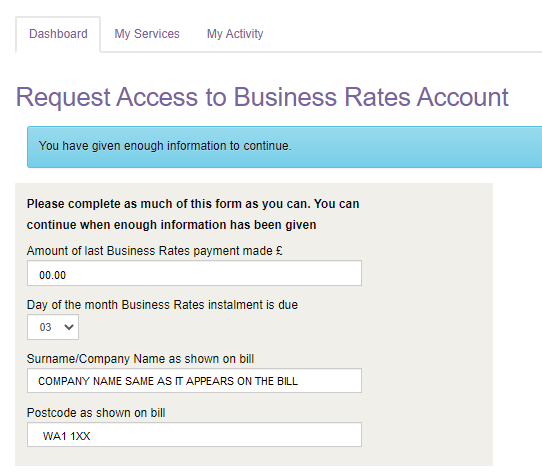

We will ask you for some information related to the Business Rates account so we can then link your online account. Please answer the questions and click the Next Button

If we have enough information, we will link your Business Rates and online account and the website will take you back the My Services page.

Request Access Questions

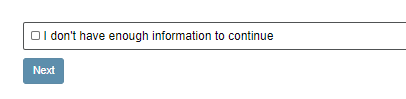

If you don't have the information to continue, tick the don't have enough information box and click the next button.

At this point we can't verify the Council Tax account so we will send a letter to your address with a PIN number and instructions of how to use it to link your Council Tax Account.

I don't have enough information tick box

Send me a PIN panel

Before you begin

We will ask you for some information from the following list to link your online account and your Landlord account. You may not have all the details listed, however the more information you have the better.

Sign in to the Citizen Portal

Click on the 'My Services' Tab and Add Service and select Landlord using the button, or

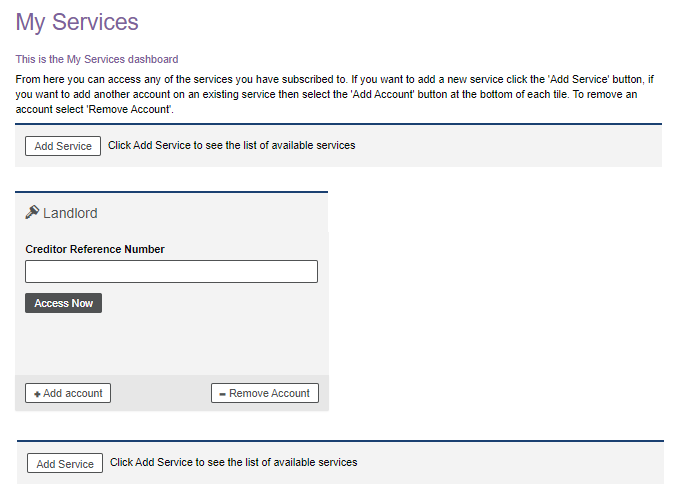

My services

Enter your Creditor Reference number into the Landlord Panel and click the Access Now button

Add Landlord Panel

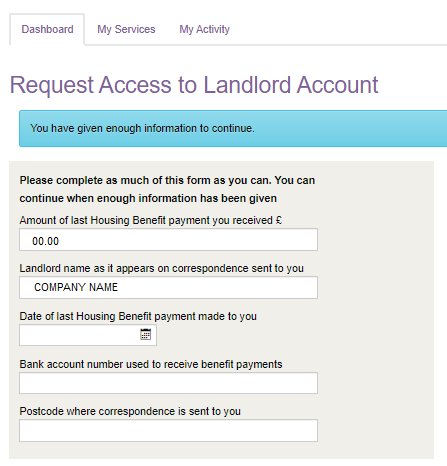

We will ask you for some information related to the Landlord account so we can then link your online accounts. Please answer the questions and click the Next Button

If we have enough information, we will link your account and the website will take you back the My Services page.

Request Access Questions

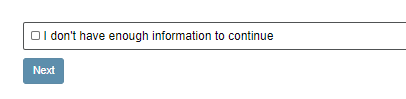

If you don't have the information to continue, tick the don't have enough information box and click the next button.

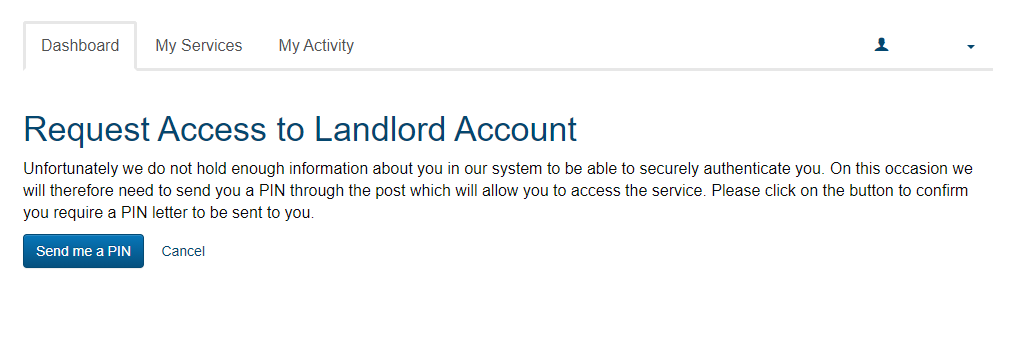

At this point we can't verify the Landlord account so we will send a letter to your address with a PIN number and instructions of how to use it to link your accounts online.

I don't have enough information tick box

Send me a PIN panel